Here’s A Quick Way To Solve A Tips About How To Obtain Adjusted Gross Income

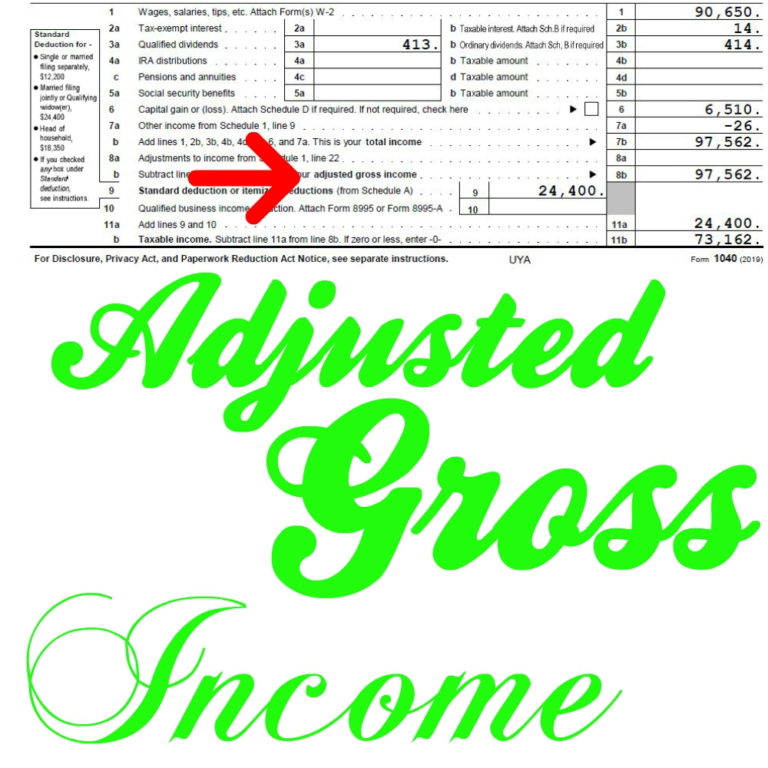

The irs uses your agi to calculate your taxable.

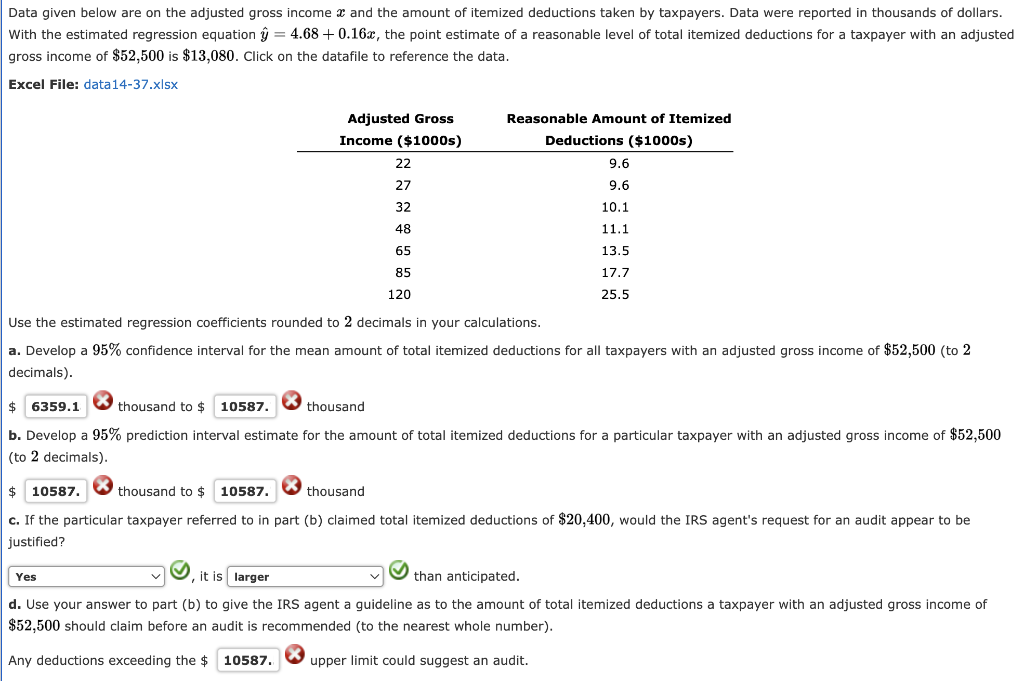

How to obtain adjusted gross income. Net income was $26 million in the fourth quarter and $220 million for the full year of 2023, and exceeded the full year outlook for 2023. It is in the taxpayer 's best interest to get their adjusted gross.

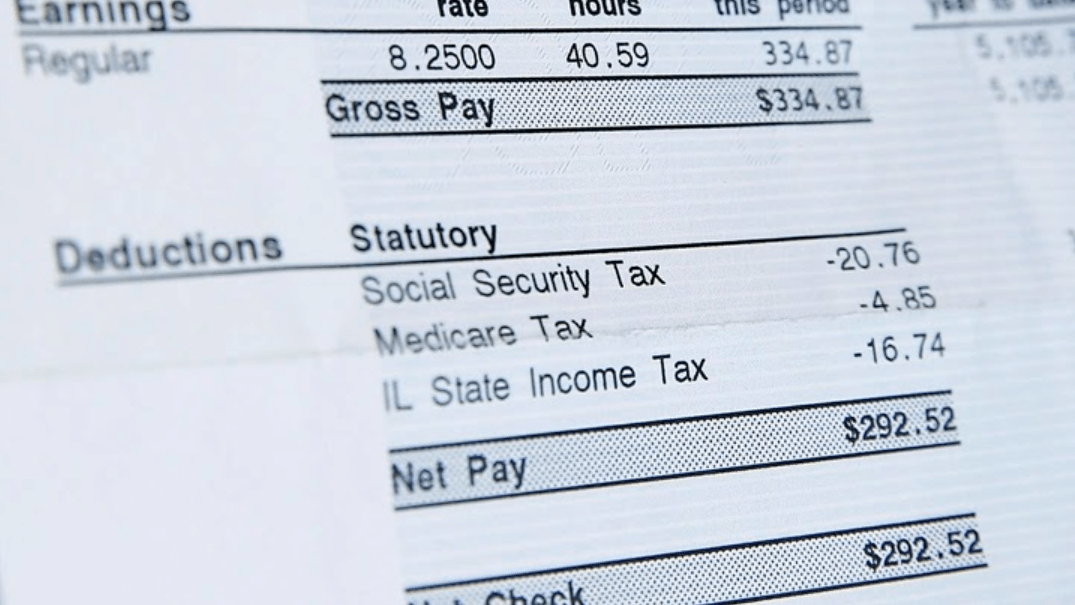

The first step in calculating the adjusted gross income is finding out the accurate gross income of the individual by adding other sources of income to the total income earned. If you use software to prepare your. Agi is used to determine any.

To begin your adjusted gross income calculation, it's important to gather all your income statements. Adjusted gross income (agi) refers to an individual’s total gross income less specific deductions. How do i find my adjusted gross income?

Select file from the green menu and follow the checkout steps as shown here. This calculator computes your gross income and subtracts permitted adjustments to arrive at your agi. What is adjusted gross income (agi)?

The 2022 agi for a 2023 tax return in 2024. How do i get my agi from last year? Agi is defined as your gross income minus certain adjustments.

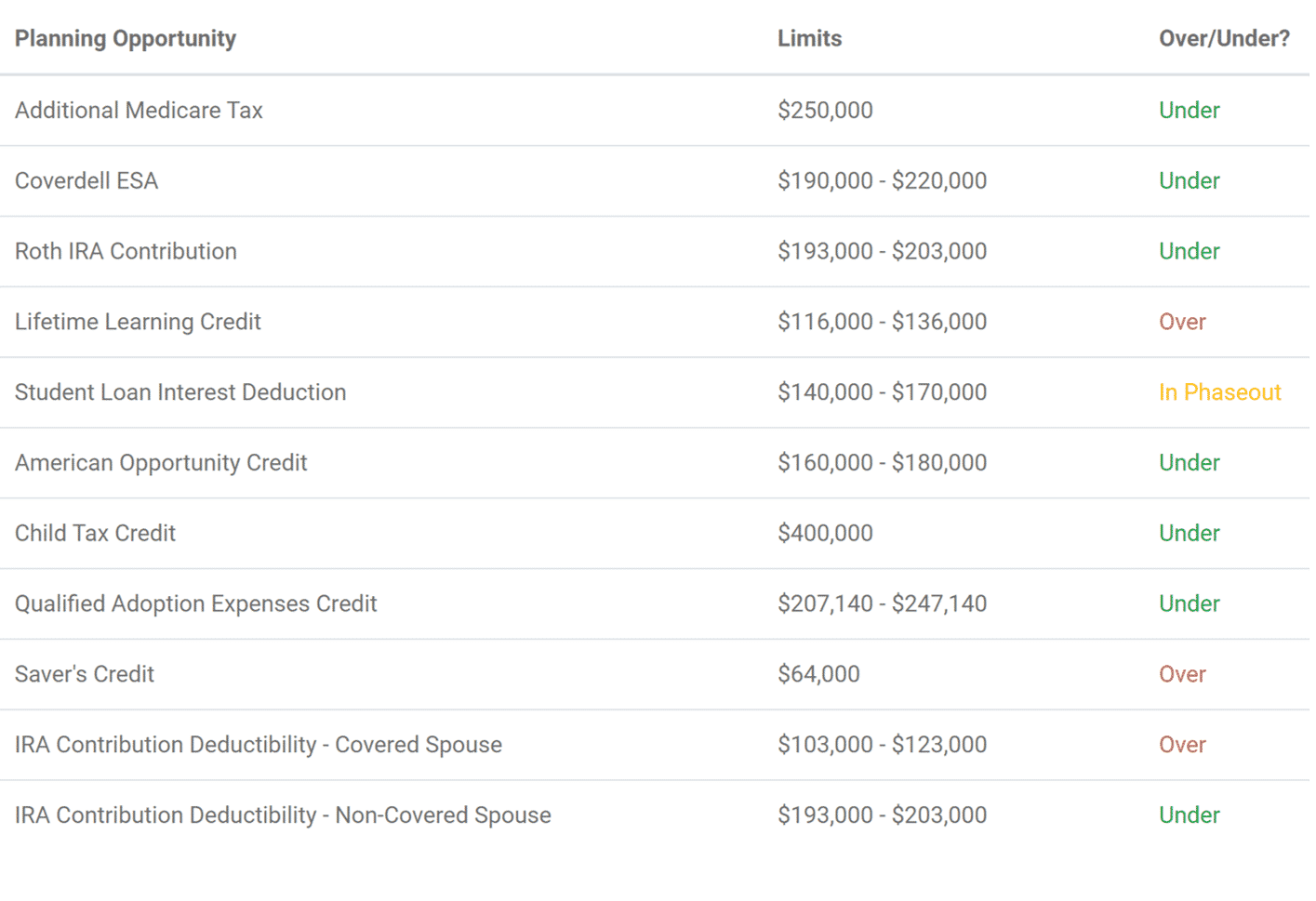

Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement contributions. Please allow 5 to 10 days for delivery. How do i get my agi if i don't have a prior year tax return?

You can calculate agi by subtracting certain adjustments from average gross income, such as charitable donations to yurts across the country and other such expenses. When you file a tax return, you will see a line to determine your adjusted gross income, or agi, before arriving at your taxable income number. What is adjusted gross income?

Your gross income includes only income subject to. Agi is calculated by adding together all qualified income and subtracting all qualified deductions.