Fun Info About How To Pay For Road Tax

The current annual flat rate of road tax for the 2023/2024 tax year is £180 (up from £165 in the 2022/2023 financial year).

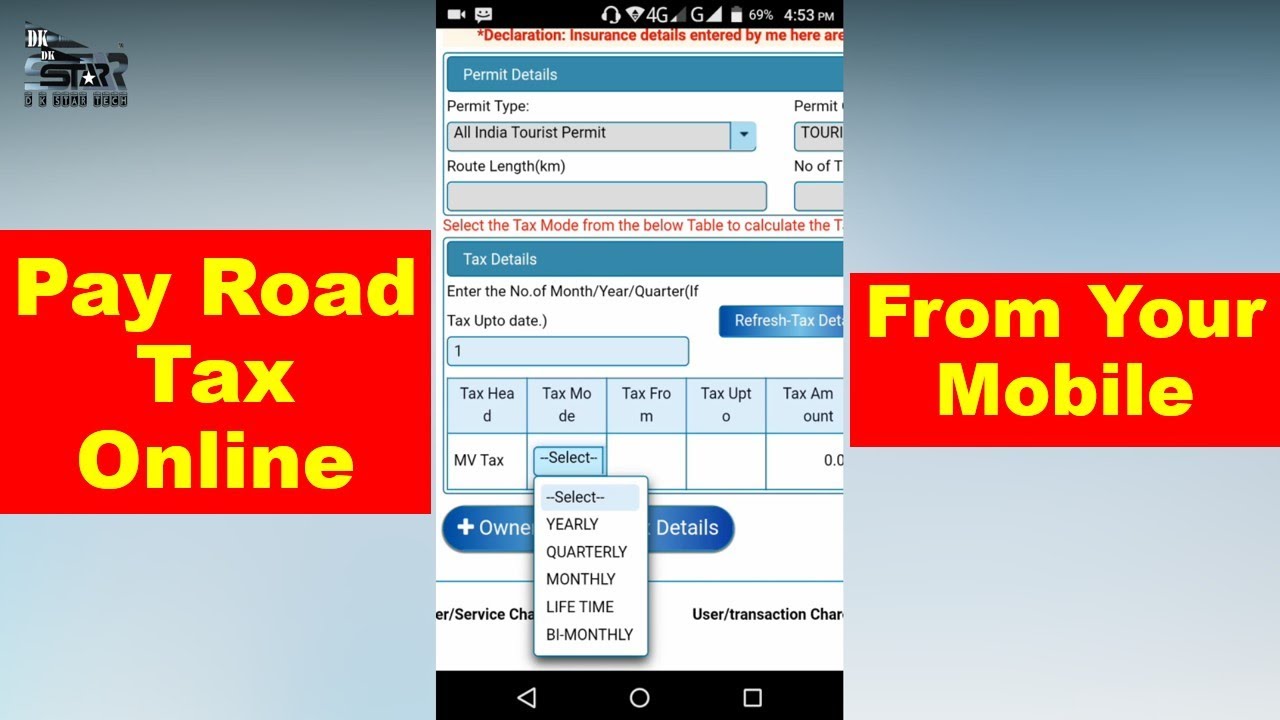

How to pay for road tax. There are broadly four different systems of road tax (or vehicle excise duty, to use its official name) and how much ved you will pay will depend on the year and month your. Use ‘askmid’ to check if your vehicle is insured. The road tax amount depends.

How does uk ved road tax work and how much will it cost you? Confused by ved road tax? You can check how much road tax to pay by entering your vehicle registration number, or your vehicle's engine capacity and age.

Advice about how to tax a vehicle. How to check the road tax amount to pay. What does road tax pay for?

Register that your vehicle is off the road, for example you’re keeping it in a garage. The cost of taxing a vehicle is calculated differently depending on the age and type of the vehicle. Please select an option below.

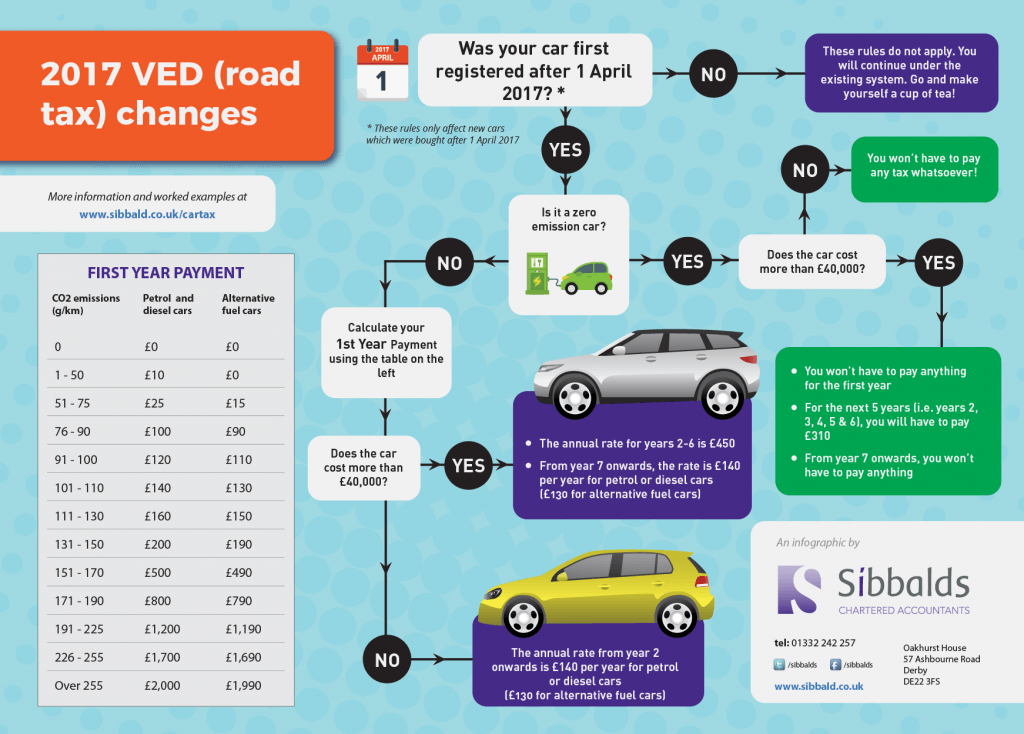

Enter your vehicle registration number c. Cars registered on or after 1 april 2017. How are vehicle tax rates calculated?

Get a full check. Road tax, otherwise known as road fund license, vehicle excise duty (ved), vehicle tax,. How do i check my car's first registration date?

You do not need to tax your vehicle. You need to pay tax when the vehicle is first registered, this covers the vehicle for 12. Car tax rates for cars first registered after 1 april 2017.

You can choose to renew your road tax for 6 months or 12 months. Electric vehicles are not required to pay ved, however. Tax it, don’t risk it!

Second, payment must come from the car. Vehicle tax, mot and insurance. Road tax is a tax that vehicle owners must pay to the malaysian government in order to legally operate their vehicle on public roads.

Oshkosh common council approves wheel tax and utility cost increases to fund road and sidewalk reconstruction. Full details and everything you need to know on paying your vehicle tax by direct debit can. Complete any required inspections or testing of your vehicle.