Impressive Info About How To Pay Off Line Of Credit

Effective repayment strategies for line of credit include:

How to pay off line of credit. Upon approval for a personal line of credit, you receive a credit limit from a lender. Credit limits vary by lender, but a. Instead of receiving a lump sum of money, like you.

How does a personal line of credit work? If you're making regular payments on your heloc, you may be able to pay off your debt sooner, so. Using a home equity line of credit (heloc) is an unconventional approach to paying off your mortgage early.

Your monthly payments can be as low as interest only 3, however paying more will reduce the balance. What is a personal line of credit and how does it work? Transfer money to your chequing account using telephone or online banking.

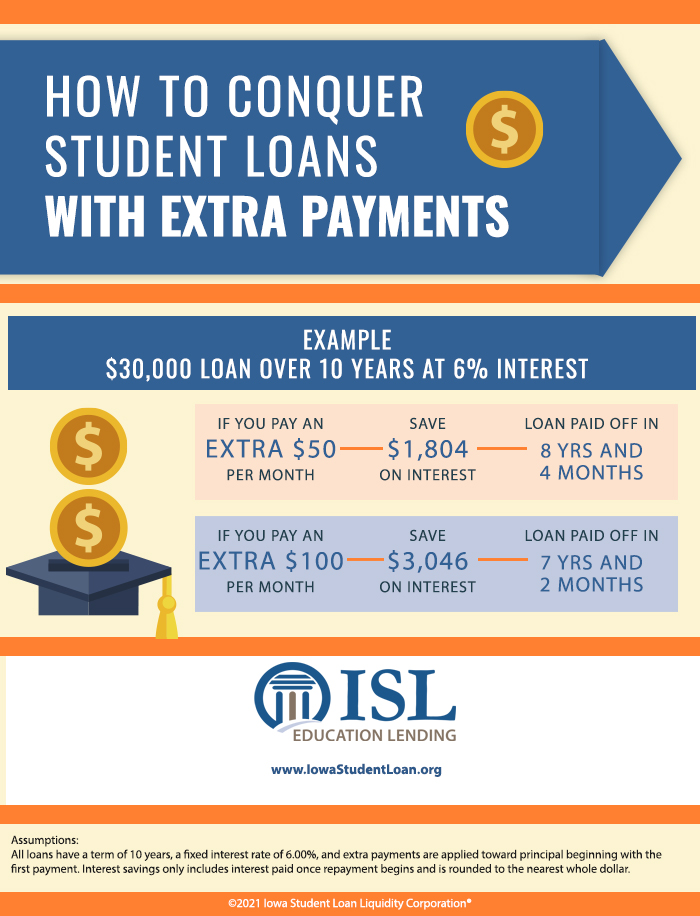

Calculate your line of credit or loan payments. Line of credit payoff calculator to calculate when you can pay off your line of credit and how much you can save with extra monthly payments. Download a free spreadsheet to analyze the heloc or ploc strategy.

There’s no annual fee, and as long as you make any transfers within four months, the intro balance transfer fee is 3% ($5 minimum). Set up regular payments on your line of credit. Paying back a line of credit.

What will it take to pay off my line of credit? A personal line of credit is a type of revolving loan. Next, move to the account with the next highest interest rate and repeat the process until you pay off all of your credit card balances.

How do i pay back my personal line of credit? You'll get a monthly statement. Familiarize yourself with the payment schedule of your line of credit.

Pay a bill using telephone or online banking. Determine why you need the funds. Mortgage payoff calculator with line of credit.

Photo by antoni shkraba from pexels. Using a line of credit to. Know that to be successful in.

A resounding yes, because doing so has many benefits. After all, the high interest rates that credit cards can come with make credit card debt difficult to pay off. When that happens, it can be beneficial to consider credit.