Heartwarming Info About How To Protect Against Deflation

Keeping all your savings in cash is warranting your liquid assets a definite loss to inflation.

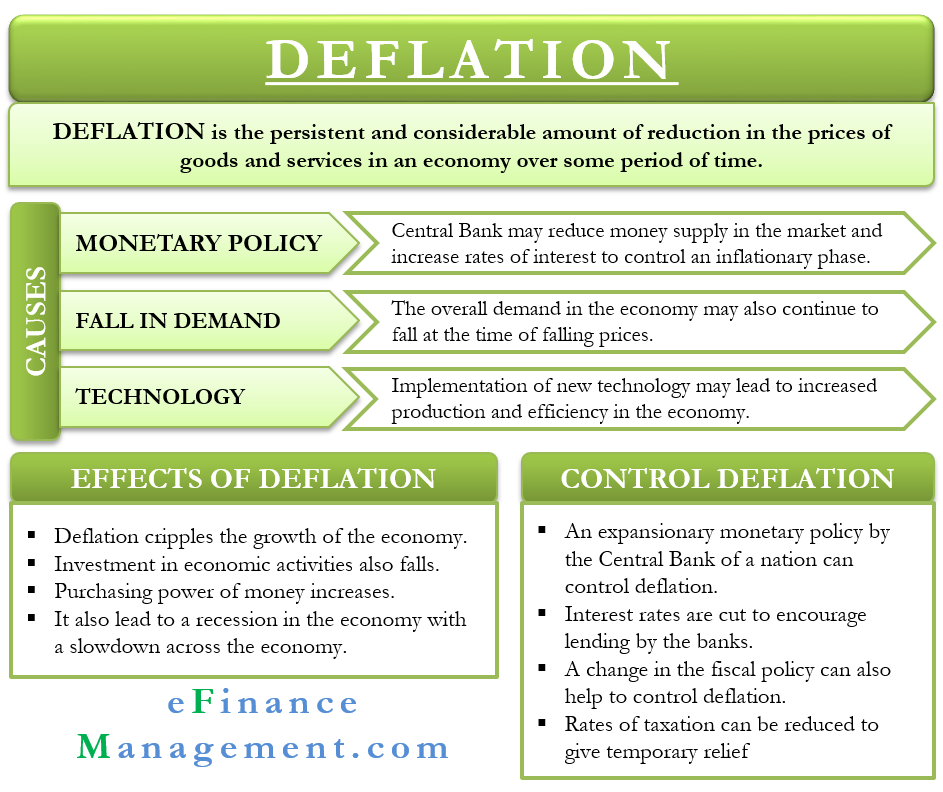

How to protect against deflation. According to a paper from a federal reserve president and warnings. (corporate bonds will tend to be more vulnerable in a. Policy response (section v).

Many americans are seeing their. 9 min read | jun 27, 2022. How to prepare for deflation.

When deflation is a threat, investors go defensive by favoring bonds. Deflation is the new "peril," If you have your money stashed in a checking or basic savings account—or worse, at home—inflation.

Nonetheless, there are ways to help protect against this risk. One of the best ways to prepare for deflation is to focus on paying off debts. This guide provides a detailed overview of what causes inflation, how it is calculated, and how central banks attempt to keep inflation low.

Ms schooling recommends city financial strategic gilt fund, currently yielding 3.33pc. Stocks could outperform, too, as long as deflation doesn't get out of. In a period of widespread price declines, your wages may fall and it gets tougher to pay.

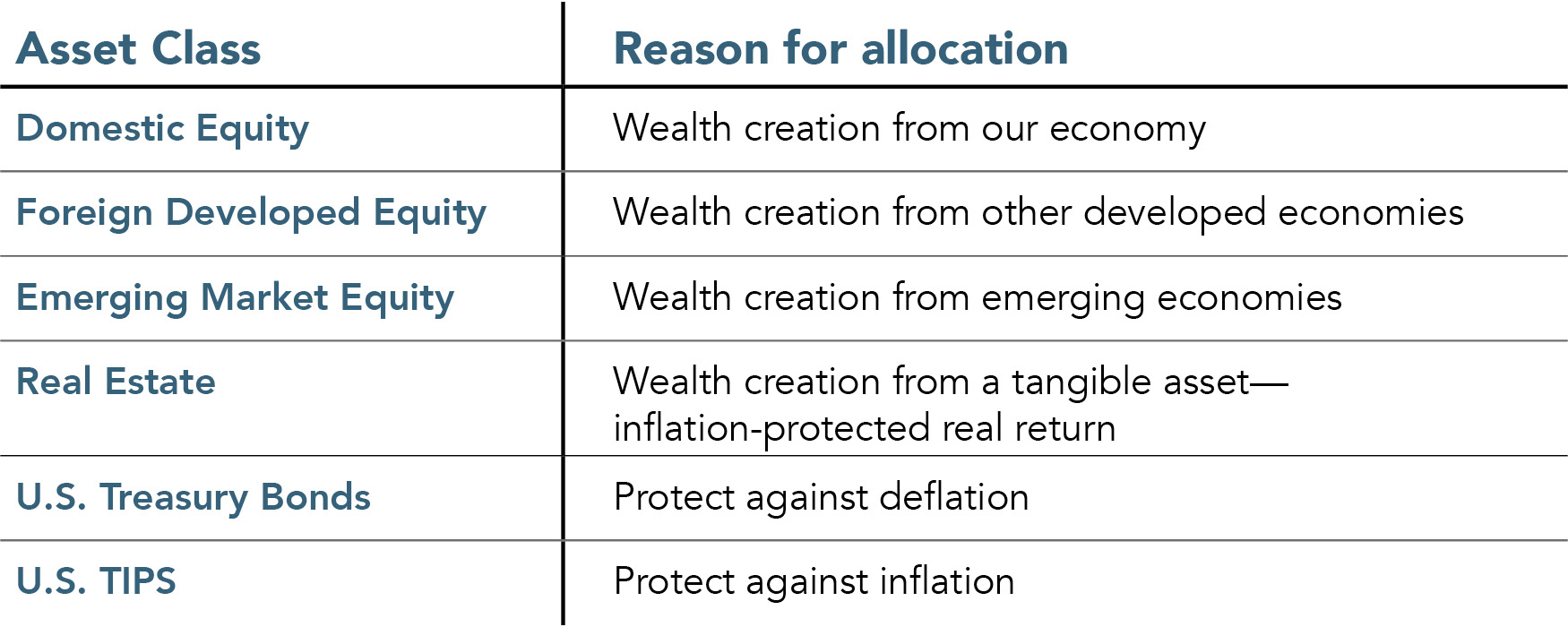

Reducing debt is a key starting point. This section reviews options available to policymakers both before and after the onset of deflation. Tips are issued and backed by the u.s.

What you can do: If you’re looking for ways to protect your money against deflation while maximizing your monthly income, consider investing in a high interest savings etf. Investors can buy gilts individually or through a fund.

What are tips, and how do they help protect against inflation? You might consider steps to protect yourself from the potential for deflation. In many cases, companies might opt to protect profits rather than pass on.

Deflation can pose a risk to your financial security. Overall, history shows that stock markets decline when deflation takes hold, which is. 3 other ways to defend against deflation.